“Better late than never” applies when it comes to filing income tax returns. Here’s what you should know.

“Better late than never” applies when it comes to filing income tax returns. Here’s what you should know.

Maybe you didn‘t get your 1040 done in time in a previous year and you figured you couldn’t still file your income taxes. Or maybe you thought you’d owe money that you didn’t have. Or perhaps you simply forgot. The IRS knows that people file late sometimes, and it has systems in place to deal with that.

It’s absolutely critical that you file every year, for a variety of very good reasons. Failure to file means that you might:

- Accrue interest and penalties.

- Miss out on a refund (you can claim a refund for up to three years after the return due date).

- Jeopardize your Social Security benefits. If you’re self-employed and don’t file, you will not be credited for income that year.

- Have an issue if you can’t supply a tax return to a potential lender.

File It ASAP

As soon as you realize you have a past-due tax return, you should prepare and file it. You can find forms and instructions from prior years here.

If you missed a filing deadline from a previous year, you can find the forms you need on the IRS website.

If you can’t pay what you owe when you file, you can ask for an additional 60-120 days to fulfill your financial obligation. If that’s not enough time and/or you’re going to need to pay in installments, you can apply for an IRS Payment Plan.

What If You Don’t File?

The short answer is this: The IRS may file a substitute return for you. If this happens, you may not get all of the deductions and credits that you should. So we advise you to still file a tax return that includes everything, even if the IRS already prepared a substitute return. The agency usually adjusts the return they created to reflect credits, deductions, and exemptions when they’re made aware of them.

The IRS will notify you if the agency files a substitute return. You’ll receive a Notice of Deficiency (CP3219N), otherwise known as a 90-day letter, which gives you 90 days to either file your return or submit a petition to Tax Court.

If you fail to do either of those things, the IRS will go ahead with its proposed assessment, which will, of course, trigger a tax bill. Failure to pay it will result in your account going into the collection process. This can include the filing of a federal tax lien or a levy on your bank account or wages. If you continue to ignore the bill, you may be subject to additional penalties and/or criminal prosecution.

Potential Problems

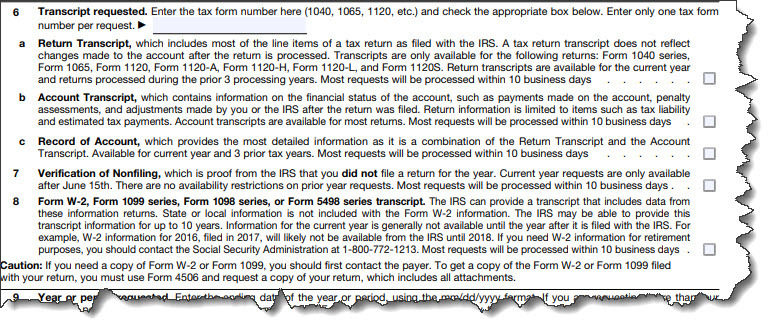

You may find as you’re preparing your return that you need additional information. For example, you might need information from a tax return filed in a prior year. If that happens, you can use the IRS’ Get Transcript service. Or maybe you’re missing wage and other income information from the year of the return you’re filing. You can always contact your employer or other source of income. Or you can complete an IRS Form 4506-T, Request for Transcript of Tax Return and check Box 8. The agency can provide data from Form W-2, Form 1099 and 1098 series, and Form 5498 series.

The IRS offers a service that provides you with wage and income data from several types of forms.

Where to Send Your Past-Due Return

If you realized on your own that you didn’t file a return and wish to file it, you should send it the same way and to the same address that was originally indicated. If you received a notice, though, submit it to the address provided on it. The IRS says it takes roughly six weeks to process a completed past-due return.

Any correspondence from the IRS can create a lot of anxiety, as can realizing you missed a tax deadline, perhaps by a lot. We encourage you to contact us if you’re at all concerned about a return you didn’t file. We can help you understand what your options are and how to proceed. We can also help with tax planning throughout the year, so you don’t have to deal with a past-due return again.

We offer our tax planning strategies and tax return preparation services to small businesses and individuals. From routine income tax returns to multi-state tax planning and corporate taxes for businesses, our tax reduction techniques are reliable, legal, and effective.

Call us now at 239-992-9299 to learn more or request your free consultation online to get started.